ESI Return FilingEmployee's State Insurance(ESI) is a self-financing social security and health insurance scheme for Indian workers. ESI Registration is mandatory for employers having 10 or more employee. For all employees earning Rs.15,000 or less per month as wages, the employer must contribute 4.75% and employee must contribute 1.75% towards ESI. The ESI fund is managed by the ESI Corporation (ESI) according to rules and regulations stipulated therein the ESI Act 1948, which oversees the provision of medical and cash benefits to the employees and their family through its large network of branch offices, dispensaries and hospitals throughout India. ESI is an autonomous corporation under Ministry of Labour and Employment, Government of India. Enterslice can help you obtain ESI registration for your business. All employers having 10 ore more employees are required to be registered with Employee State Insurance (ESI) Corporation. Those entities having ESI Registration must then file ESI returns. ESI returns are due half-yearly. IndiaFilings can help file ESI returns for your business. Our ESI experts can also help you computer ESI payments and maintain ESI regulation compliance for your business. Use Remin Due to know more about your due dates for ESI return and ESI payment due date. ESI Registration in India - Hindi Video : https://www.youtube.com/watch?v=yOFLjddMuus ESI Registration Procedure: Documents RequiredThe following documents are required for registering under the ESI scheme: 1. A registration certificate or a license obtained under Shops and Establishment Act or Factories Act; 2. Certificate of registration (Memorandum and Articles of Association in case of a private limited company, partnership deed for LLPs, etc); 3. Certificate of registration for all entities and commencement of production for factories; 4. A list of employees with their monthly compensation, in detail; 5. A list of directors, partners and shareholders of the company; 6. The PAN card of the business and address proof of the establishment/firm; 7. Bank statements of the organization, with evidence of commencement of operation. Also Read: ESIC – Step By Step ESI Registration Procedure Online in IndiaESI Registration Procedure: Steps Involved1. Once the documents are ready, the company can apply for registration by submitting the Employer’s Registration Form (Form-1). 2. A PDF format of the form is available on the website. Fill in the form and submit it to ESIC for registration on the official website. 3. Once verified, a registration number, a 17-digit unique identity will be provided to the organization. The ESI filings can be done once you receive the 17-digit number. 4. Employees registered under the scheme get an ESI card after submitting a form with photographs and details of family members. 5. Although the registration is permanent, and the number is valid for the lifetime of the company, any new changes, such as employee additions, need to be intimated to the ESI. Documents for ESI ReturnsThe following documents must be maintained regularly for filing ESI returns. 1. Attendance register 2. Register for Form 6 3. Register of wages 4. Register of any accidents on the premises 5. Inspection book 6. Monthly challans and returns submitted for ESI Our Recommendation: ESIC Return and other Annual Compliance

9 Comments

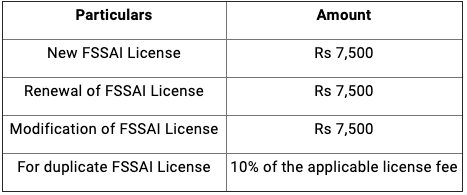

What is an FSSAI Registration?FSSAI stands for Food Safety and Standards Authority of India which is an organization that monitors and governs the food business in India. It ensures the food products undergo quality checks thereby curtailing the food adulteration and sale of sub-standard products. It is responsible for the registering and licensing of the food business operators (FBO) in India and it lays down the rules and regulation for running the food business in India. Who Should Obtain FSSAI Registration?Every food business operator involved in the manufacturing, processing, storage distribution and sale of food products must compulsorily obtain FSSAI Registration or License. FSSAI Registration is different from FSSAI License in the sense that depending on the size and nature of the business, FBO should obtain the necessary registration or license. It is a 14-digit registration or a license number which is printed on all the food packages. This registration procedure is aimed to create more accountability on the FBO to maintain the quality of the food products. FSSAI Registration/ License TypesBusiness entities can obtain the food license by applying through the FSSAI Food Licensing and Registration System. The food license can be obtained under various categories listed below: 1. FSSAI State License: Small & medium business entities like food manufacturers, transporters, marketers, retailer sand food processing units must obtain food license from the state government. 2. FSSAI Central License: Large Scale food units and business operators like export-oriented nits, large manufacturers, importers, and food agencies who supply food in railways, airports or seaports, must obtain their food license from the central government. 3. FSSAI Registration : Small food manufacturers and people in the food business can obtain their License from state government by submitting the required documents. Fee Structure for FSSAI LicenseDocuments required for FSSAI RegistrationFSSAI registration is mostly applicable for petty food retailers and the procedure for obtaining FSSAi registration is very simple. The documents required for FSSAI registration are:

For Obtaining An FSSAI State & Central License1. Duly completed and Signed Form-B (in duplicate) by the proprietor or partner or authorised signatory. 2. Processing unit blueprint/layout plan showing dimensions in metres/square metres and operation-wise area allocation. This is mandatory for manufacturing and processing units only. 3. Full address and contact details of the list of Directors/Partners/Executive Members of Society/Trust. 4. Equipments and Machinery name and list along with number, installed capacity and horsepower used. This mandatory for processing and manufacturing units only. 5. Government Authority issued Identity and Address Proof for Proprietor/Partner/Director(s)/Authorised Signatory. 6. List of food category the business intends to manufacture. (in case of manufacturers). 7. Authority letter which includes the name and address, responsible person nominated by the manufacturer along with alternative responsible person indicating the powers vested with them viz assisting the officers in inspections, collection of samples, packing and dispatch (for manufacturers/processors). 8. A recognised/public health laboratory issued Analysis Report (Chemical and Bacteriological) of water to be used as ingredient in food. This is mandatory only for manufacturing and processing units. 9. Proof of premises possession. (Sale Deed/Rent Agreement/Electricity Bill, etc.) 10. Certificate or plan of Food Safety Management. 11. Copy and certificate obtained under Coop-1861 or Multi State Cooperative Act - 2002 in case of cooperatives. 12. Affidavit of Proprietorship or Partnership Deed or Memorandum and Articles of Association towards the constitution of the firm (optional) - (a) FSSAI Self-Declaration for Partnership. 13. Source of raw material for meat and meat processing plants. 14. In case of units manufacturing packaged drinking water, packaged mineral water and/or carbonated water, the pesticide residues report of water from a recognised public health laboratory must be produced. 15. No Objection Certificate (NOC) or a copy of License from the manufacturer (mandatory for re-labelers and repackagers only) - (a) Declaration and Undertaking System Plan or Certificate. 16. In case of Milk and Milk Products processing, the business must produce the source of milk or procurement plan for milk including the exact location of milk collection centres. 17. Certificate from the Ministry of Tourism. 18. No Objection Certificate (NOC) from the Municipality or local body. 19. Recall plan wherever applicable. 20. Form IX - Nomination of Persons by a Company along with the Board Resolution. 21. Self Declaration of number of vehicles - for transporters. 22. The declaration form - from Delhi or Himachal Pradesh. How Enterslice will help you to get FSSAI RegistrationAn interested seeker may raise their query at [email protected]. Detail information is also provided on our website www.enterslice.com.

What is Non Disclosure Agreement?A Non-Disclosure Agreement (NDA) is a legally enforceable contract that establishes confidentiality between two parties—the owner of protected information and the recipient of that information. By signing an NDA, participants agree to protect confidential information shared with them by the other party. In addition to not divulging or releasing the information without consent, the recipient also agrees not to copy, modify, or make use of the information in any way that is not authorised by the owner. A signed NDA form can help you avoid a lot of problems as a business owner. Without a confidentiality agreement in place, your trade secrets and sensitive information can be disclosed publicly or otherwise used by employees, vendors, clients, or anyone else that you share them with. A Non-Disclosure Agreement lets the recipients of your proprietary information know that you expect confidentiality and it authorises you to take legal action if the contract is violated. Other names for a Non-Disclosure Agreement include: NDA, Non-Disclosure Form, Confidentiality Agreement, Confidentiality Statement, Confidential Disclosure Agreement (CDA), Proprietary Information Agreement (PIA), or Secrecy Agreement. NON DISCLOSURE AGREEMENTA non-disclosure agreement full form (NDA), also known as a confidentiality agreement (CA), confidential disclosure agreement (CDA), proprietary information agreement (PIA) or secrecy agreement (SA), is a legal contract between at least two parties that outlines confidential material, knowledge, or information Why Non-Disclosure Agreement is required?Whether you are considering a new business relationship or you have already entered one, it's often smart to make a Non-Disclosure Agreement. Employees, business partners, and vendors are often privy to sensitive information that should be protected from disclosure to the outside world. Without a signed confidentiality contract, your business data and trade secrets could become public knowledge without your consent. Types of Non-Disclosure AgreementsNDA are of three types:-

When to sign a Non-Disclosure Agreement?

Benefits of entering into an Non-Disclosure AgreementAs discussed above NDA is an agreement between two or more parties whereby they agree to disclose confidential information among themselves but excludes all other from the right of accessing that information, except in some circumstances. Five Advantages of signing an Non-Disclosure Agreement:

Enterslice can help you make an Non Disclosure Agreement, all you have to do is follow simple steps:

ABOUT 80G REGISTRATION :Our Business licensing and regulatory approval team provides all possible help in dealing with the office of Commissioner of Income Tax (Exemptions) to get registration under section 80G & 12A of the Income Tax Act, 1961 for your NGO at very affordable prices. 80G registration helps you receive donations and enable you to issue exemption certificates to the people who have donated to your NGO. 12A Registration exempts your NGO’s excess income over expenditure from income tax purview. A NGO, registered under Section 80G of the Income Tax Act, 1961, can issue exemption certificates to the person, who has made some donations to the NGO. Such exemption certificates issued by the NGO will enable the donor to claim and avail income tax exemptions up to the 50% of total donated amount. Therefore registration under Section 80G is very important for a NGO, so, it can receive donations from general population, corporate under CSR Schemes etc. Steps to get 80G Registration :

Information & Documents Required for 80G Registration :

How many cups of coffee and scribbles on a paper did it take for you to zero-in to design your logo? A dozen, right? If you don’t register your trademark, then someone else can. It is universally accepted that a unique brand and logo is the most valuable asset for the entity as customers can swiftly recognise your product or services among competitor’s products. It has become very important to protect your brand name and logo from misuse or duplication by others. Registration of a trademark confers a number of advantages over the use of an unregistered Brand name and Logo. Advantages of Registering Trademark in India include:

What can be registered as a trademark?

Procedure For Trademark Registration in India

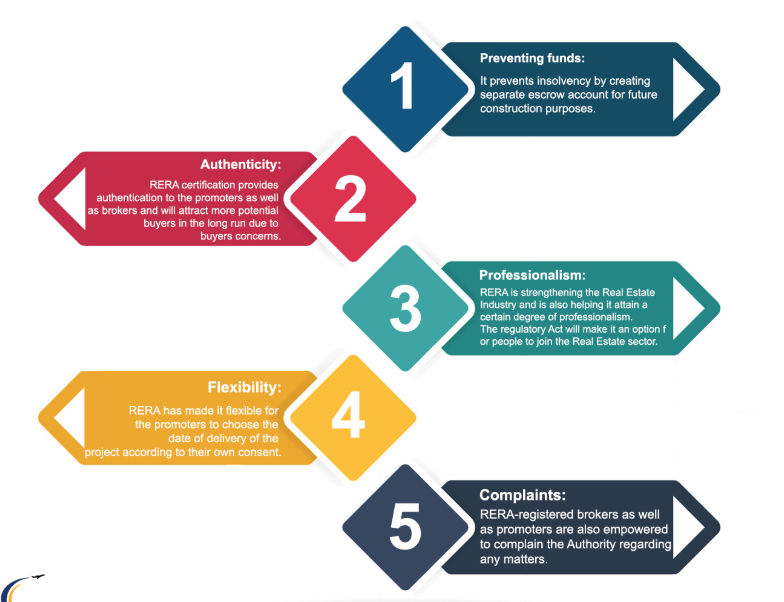

Enterslice will help you in obtaining Trademark RegistrationRERA stands for Real Estate Regulatory AuthorityRERA is an act for regulation and promotion of the real estate sector to ensure the sale of apartment, plot or building in an efficient and transparent manner. The Act aims to protect the interest of consumers. It was enacted by the Parliament in May 2016 and the Act has come into force with all its 92 sections from 1st May, 2017 across India. So far, 14 states and union territories such as Uttar Pradesh, Gujarat, Bihar, Madhya Pradesh, Odisha, Andhra Pradesh and Maharashtra have notified their rules with RERA and the others are expected to follow suit. The implementation of RERA is expected to bring relief to the homebuyers as builders will be accountable for the timely delivery of the projects and to protect buyers from fraud sellers. The developers would also gain from the increased confidence of the consumers in a regulated environment. It is mandatory for the developers to get RERA registration & all approvals from various government agencies before launching a project and disclose all the information on the website that the respective state RERA regulatory authority will set up. Real estate agents will be provided a rera registration number by the regulator which they have to mention in every property sale. This will help in eliminating the possibility of misleading the purchaser. The authority has wide ranging powers to impose penalties and imprisonment of agents in case of violation of law. Benefits of RERA RegistrationKey Provisions of RERA

Registration of projects under RERAAll commercial and residential real estate projects will have to register except in projects where:

Documents required for registration under RERAFollowing documents should be enclosed in hardcopy with the application:

How we can help you with RERA registration?Enterslice is a leading platform which provides all type of legal compliance services in all over India and in more than 22 countries. You just have to go through the link below mentioned steps in order to get your RERA registration in India: https://enterslice.com/rera-registration

|

Details

AuthorWrite something about yourself. No need to be fancy, just an overview. Archives

December 2019

Categories |

RSS Feed

RSS Feed