|

In India, NBFCs or Non-Banking Financial Companies does not depend on Current Account Savings Account (CASA) to raise the money because the CASA deposits are only for banks. Whereas the Reserve Bank of India (RBI) provides licenses to the banks to accept the funds from the public which means all the Non-Banking Financial Companies have to look for an alternative source of money supply, and these are higher than the traditional deposits taken by banks. The rate of interest is in between 4% to 6%. In this blog, we discuss the methods use by Non-Banking Financial companies to raise money in India.

What is the business model of NBFCs in India? Non-Banking Financial Companies raise funds are high, whereas the banks raise the money supply at a very low rate, and these financial companies end up raising funds at a higher rate of interest. As a result, they are causing the obstacle rate on their funds to increase proportionally to maintain Net Interest Margin between 1 to 3% which causes Non-Banking Financial Companies to take an alternative method for distribution of funds to create a higher return. Effectiveness of Fund Raising Following are two main objectives of raising funds are:

What are the different KPIs in assessing Liability/Asset in an NBFC? The departments of the treasury and rupee resources depend on the following factors:

Following are the different sources of funds for any Non-Banking Financial Companies:

Following are some services which are offered by the Non-Banking Financial Companies that have access to the automatic route in FDI:

Conclusion Most of the NBFCs don't rely on Current Account Savings Account deposits to raise resources as CASA deposits are for banks only. This means Non-Banking Financial Companies have to consider alternate sources of the money supply. These primary sources of funds are essential for NBFCs. In case if you have any legal-related queries, then feel free to contact Enterslice. Our professional experts are readily available to solve your questions.

1 Comment

Overview on Nidhi Company Registration

Do you want to start a finance/loan business in India? Then you are at right stage because Nidhi Company is the most easy and affordable way to start loan business in India. It only requires 7 person with easy documents required to start the Nidhi Company. The minimum capital requirement for Nidhi Company registration is Rs.5 lakh.

Nidhi Company can only do business of accepting deposit and lending money to its members only. It cannot deal with the public directly and can only work with its members. However, one can easily make members under Nidhi Company with few documents and easy process. Also, Nidhi Company registration in India is the only form of company available to start the loan company in India without RBI approval. Nidhi Company can open three branches after three years of working within the district. Further, to open any branch outside the district, the company shall require RD approval. Furthermore, the Nidhi Company cannot work outside the state. Hence, if you want to expand your business to another state, then you will need to register another Nidhi Company. Nidhi Company Registration Process

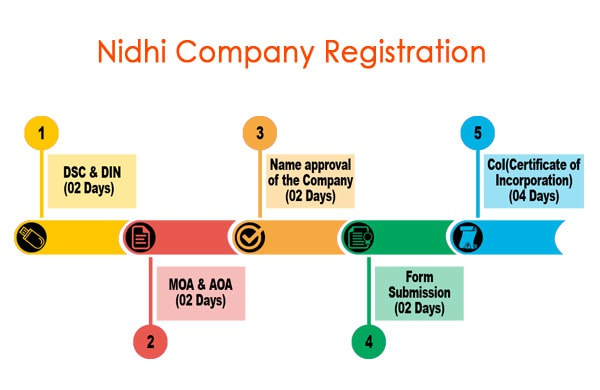

Nidhi Company Registration process is the simple but will require a professional to complete the same. Further, the procedure has been changed completely by the government to promote ease of doing business. However, instead, government ends up making the process a little complexed. However, Hubco.in is specialized in Nidhi Company Registration with a experience of more than 200 Nidhi Company registration and managing hundreds of Nidhi Company across India. Know all 6 steps in Nidhi Company Registration.

Our Recommendation: Rules Regarding Nidhi Company Setup in India Full Fledged Money Changer (FFMC)A Full Fledged Money Changer (FFMC) is an authorized entity who may purchase foreign exchange from non-residents and residents of India and sell the same for private and business travel purposes only to the people visiting abroad. As Section 10 of the Foreign Exchange Management Act, 1999 prescribes, authorized money changers are the only entities in the country that can deal in money changing activities and offer necessary foreign exchange services. For the purpose of removing the obstacles faced by foreign visitors and tourists, particular firms and hotels have also been offered the registration to deal in foreign currency notes, coins and traveller’s cheques under the directions issued by the RBI frequently. No individual is permitted to carry on or advertise that they carry on money changing business unless they own a valid FFMC License from RBI. Any individual found undertaking any sort of money changing business without a valid license is liable to be penalised under the Act. Types of FFMC LicenseThe following are the types of license that are required by an entity to operate as a Full Fledged Money Changer (FFMC).

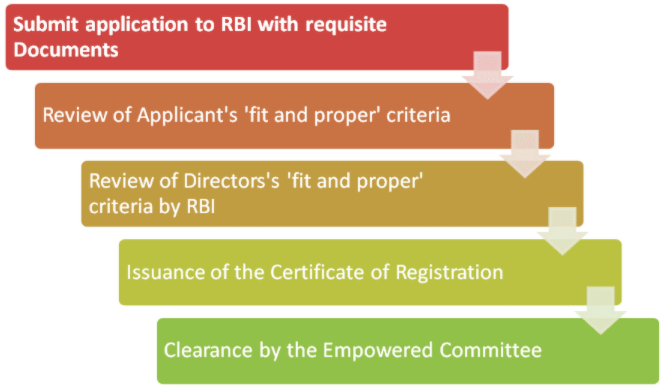

Process of Registration for Full Fledge Money Changer LicenseThe application form for the FFMC license should be downloaded from the website of RBI. Alongside the essential supporting documents, the application form should be submitted towards the Foreign Exchange Department of the Reserve Bank of India at the regional center under the domain of which the registered office of the candidate falls. The procedure of getting an FFMC License -

Our Recommendation: RBI Compliances For FFMC License How Enterslice will help you in obtaining FFMC License from RBI?You just have to visit our website Enterslice and fill your basic details like name, Email Id & Mobile No – Click on Get Started button.

As per the norms of the Securities and Exchange Board of India or SEBI an underwriter is a risk assessing entity that works for someone in exchange of some fee. The risk assessment party or UNDERWRITERS as they have been called assumes and evaluates the risk involved in the planning and functioning of the other party. The fee may be charged as premium, interest, commission or spread. They do this business in the fields like insurance industry, mortgage industry, debt securities, equity market and trading, as well as banking industry. The underwriters are often termed as risk experts and help institutes to avoid financial loses in long term investments. To function as an underwriter in the market the desiring applicant need to procure license or registration under the SEBI. Underwriters Registration with SEBI needs to be done under the guide lines set by Securities and Exchange Board of India (Underwriters) Regulations laid in1993. Registration Procedure for Underwriters1. The applicant has to fill out Form A. The application has 2 major parts, namely: Part-I on General/Personal Information and Part-II on Business Information. The Part-I of application will collect information on the applicant as mentioned below:

3. Application to conform to the requirements If the application is not complete in any aspect or is not according to the instructions given in the form, then the form will be summarily rejected. Prior to rejection, the applicant will be provided one month of time to remove any objection that could have been indicated by the board. Applicants will also be provided with an additional one month to meet the requirements of the board. Also, read: What is the Eligibility for Underwriters to obtain registration under SEBI?

Any entrepreneur who wants to start a business in the food sector, be it food processing or food manufacturing, packaging or distributing, has to register for Food Safety and Standard Authority of India FSSAI.

FSSAI monitors these businesses under the guidelines and regulations listed in FSSAI Act 2006. With expert assistance from Enterslice, get Online FSSAI license in the quickest possible way in only 4 simple steps -

Who requires FSSAI food license?

Food Business Operators

Obtaining FSSAI food license is mandatory for every Food Business Operator. Whether a Food Business Operator requires a License or registration depends upon the factors like the capacity of production/ handling etc., nature of food business activities and area of operation. Importers of Food Every person who is an importer of food has to apply for a central license at their address which has been registered with DGFT while obtaining Import Export Code. Central Food Licence In case a Food Business Operator has operations in more than two states, it has to obtain one additional central License for the Head Office/ Registered Office and a separate license for each location Online FSSAI Registration in India - Complete Process

STEP 1 – CONSULTING, DOCUMENTATION & FILING

Documents Required For FSSAI Registration

How Enterslice will help you to get FSSAI RegistrationOur Recommendation: How to Apply for Basic FSSAI Registration ALL ABOUT ESI REGISTRATIONEstablished under the ESI Act, 1948, ESIC (Employees’ State Insurance Corporation) provides benefits to employees in the event of their sickness, death, disablement, injury, etc. The finance of this scheme comes from contributions from both employees and employers. Apart from employees, the family members of employees are also provided benefits under this Act. Any establishment that employs 10 or more employees is mandated by law for ESI Registration under this Act. The contribution of employers in this scheme is 4.75% and that of employees is 1.75%, thus making a total of 6.5%. WHO REQUIRES ESIC REGISTRATION?Online Esi Registration is mandatory for every factory and specified establishments who have 10 or more permanent employees and wages of such employees are less than Rs. 21,000/- per month. HOW DOES THE ESI REGISTRATION SCHEME HELP EMPLOYEES?The scheme provides full medical cover to the employee registered under the ESI Act, 1948 during the period of his incapacity, restoration of his health and working capacity. It provides financial assistance to compensate for the loss of his/ her wages during the period of his absenteeism due to sickness, maternity and employment injury. This scheme provides medical claim to his/her family members also. IS IT MANDATORY FOR THE EMPLOYER TO REGISTER UNDER THE SCHEME?Yes, it is the statutory responsibility of the employer under Section 2A of the Act read with Regulation 10-B, to register their Factory/ Establishment under the ESI Act within 15 days from the date of its applicability to them. Also Read: ESIC Return and other Annual Compliance BENEFITS OF ESIC REGISTRATIONESI Registration provides monetary and medical benefits to employees in case of sickness, maternity and employment injury and to make provisions for related matters. Some of the benefits of ESI Registration are :

TAKE FREE ADVISOR CONSULTATION FROM ENTERSLICEWhat is FSSAI?FSSAI stands for Food Safety and Standards Authority of India which is an organization that monitors and governs the food business in India. It ensures the food products undergo quality checks thereby curtailing the food adulteration and sale of sub-standard products. It is responsible for the registering and licensing of the food business operators (FBO) in India and it lays down the rules and regulation for running the food business in India. Why is FSSAI Registration Required?Every food business operator involved in the manufacturing, processing, storage distribution and sale of food products must compulsorily obtain FSSAI Registration or License. FSSAI Registration is different from FSSAI License in the sense that depending on the size and nature of the business, FBO should obtain the necessary registration or license. It is a 14-digit registration or a license number which is printed on all the food packages. This registration procedure is aimed to create more accountability on the FBO to maintain the quality of the food products. It is important to go through the documents required for FSSAI registration before applying for the registration or license. Documents Required for FSSAI RegistrationThe Food Business Operators are required to submit different types of documents to get their FSSAI Registration or FSSAI license. The Food Business Operators with the small-sized businesses that have an annual turnover up to Rs. 12 lakh are eligible for the FSSAI Registration. Small, medium or large-sized Food Business Operators with the annual turnover exceeding Rs. 12 lakh has to apply for the FSSAI license. Some of the common documents required for both the FSSAI Registration and the FSSAI license are listed below.

Also, read: How to Apply for Basic FSSAI Registration

A private limited company is an organisation that has a minimum of two shareholders, and a maximum of two hundred, with a minimum of two directors. A private limited company with one shareholder can invite friends or family members to join the organisation as the second shareholder. In addition, a private limited company also has limited liability; where a shareholder’s liability extends to the amount invested by him/her in the shares of the company.

Benefits of Private Limited Company Registration

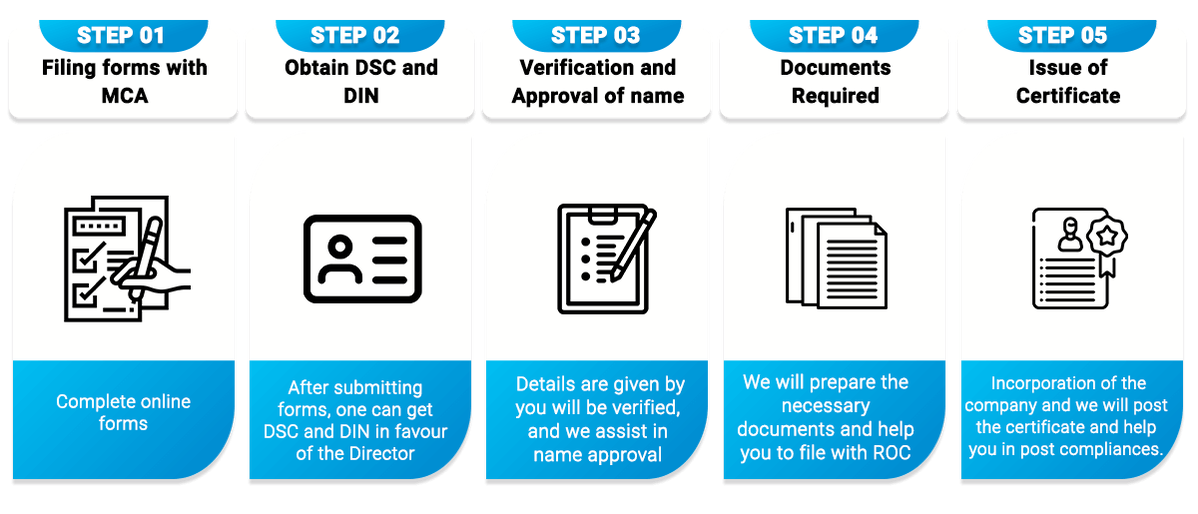

Process fo Private Limited Company Registration

Our Recommendation: Private Limited Company Incorporation Procedure

Essential Requirements for Private Limited Company Registration

Documents required for registering a private company

These documents pertain to proof of;

Apart from documents that verify identity, there are;

Also, read: 9 Reasons to Form a Private Limited Company

What is Section 8 Company Registration?In India, the Section 8 Company Registration is regulated by the Indian Companies Act, 2013 (and the amendments thereof) and the rules & regulations that are made thereunder and it is administered by the Ministry of Corporate Affairs, Government of India through the Offices of Registrar of Companies (‘RoC’) in each of the state of India. The Company Incorporation rules, the requirements, process, and the procedures vary more or less depending particularly on the type of the company that is to be incorporated. Section 8 Company is a Company that is licensed under Section 8 of the Companies Act, 2013 (the Act), erstwhile known as the Section 25 Company under the Companies Act, 1956, which had the main object; For promoting research, social welfare, religion, charity, commerce, art, science, sports, education, and the protection of the environment or any such other object, provided that the profits, if any, or the other income is applied for promoting only the objects of the company and Also, No dividend is paid to its members. Therefore, Section 8 Company is a company which is registered for charitable or not-for-profit purposes. This Company is, however, similar to a Trust or Society; an exception is that a Section 8 Company is registered under the Central Government’s “Ministry of Corporate Affairs (MCA)”whereas the Societies and Trusts are registered under the State Government regulations. This, however, has various advantages when it is compared to Trust or Society and it also has higher credibility amongst the donors, Government departments, and other stakeholders. Procedure for Incorporating Section 8 CompanySection 8 Company Registration Process:

Documents Required for Registering Section-8 Company:Documents Required for Directors (Indian Nationals) The following documents are required for Indian nationals to incorporate a Section 8 company:

Foreign nationals are required to produce the following documents for incorporating a company in India:

Want to Consult An Incorporation Expert?Enterslice will help you to get Section 8 company registration For more information send us an email at [email protected]. You can also call our customer support at +91 9870310368.

What is Nidhi Company?Nidhi Company is governed by Section 406 of the Companies Act, 2013 and Company Nidhi Rules, 2014 which has a sole objective of cultivating the habit of thrift and savings amongst its members. Nidhi companies are allowed to take deposit from its members and lend to its members only. Therefore, the funds contributed for a Nidhi company are only from its members (shareholders) and used only among the shareholders of the Nidhi Company. Nidhi Company is a class of NBFCs and RBI is empowered to issue directions to them in matters relating to their deposit acceptance activities. However, in recognition of the fact that these Nidhis deal with their shareholder-members only, RBI has exempted the notified Nidhis from the core provisions of the RBI Act and other directions applicable to NBFCs. Therefore, Nidhi Company is an ideal entity to take deposit from and lend to a specific group of people. Benefits Of Nidhi Company RegistrationThese companies work toward the sole purpose of encouraging people to save and be a help to each other as a part of mutual benefit.

Checklist For A Nidhi Company

Our Recommendation: Points to Focus on Nidhi Company Registration Requirements for a Nidhi Company Registration

Post Incorporation Requirements for Nidhi CompanyEvery Nidhi must, within a period of one year from the commencement meet all of the following criteria:

Required Documents for Nidhi Company Registration

Apart from all these documents, Some other required documents will be prepared by your Corporate Professional i.e. CA/CS for submission to ROC. Process of Registration of Nidhi CompanyUsually Nidhi Company Registration Process takes up to 45 days, Registration of a Nidhi Company consists the following steps:

How Enterslice will help you to get Nidhi Company Registration Online |

Details

AuthorWrite something about yourself. No need to be fancy, just an overview. Archives

December 2019

Categories |

RSS Feed

RSS Feed